Choosing a Medical Aid

- 26, August 2012

- In Tips

Medical Aid cover is a necessity for every household in South Africa. Protecting you and your family’s health will give a peace of mind. Choosing between medical schemes and options can be a tedious task. Considering the following information will ensure that you choose the medical aid and cover that’s right for you.

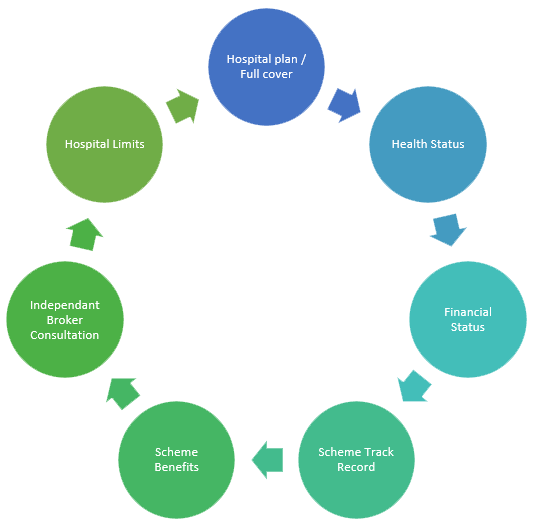

Hospital Plan or Full Cover

Note - Some schemes may have exclusions. The exclusions may enforce the fund not to accept any claims from you for a limited period. The exclusion period is usually stipulated by the medical aid and should be noted of before considering a medical aid.

Considering your current health and financial status, can you afford normal day-to-day medical expenses? Full cover are often more expensive than hospital plans.

Keep in mind that in terms of the regulations governing medical schemes, 26 specified chronic conditions (also known as PMB’s) must be covered on hospital plans. These chronic conditions is as follows:

- Addison’s disease

- Asthma

- Bipolar mood disorder

- Bronchiectasis

- Cardiac failure

- Cardiomyopathy disease

- Chronic renal disease

- Chronic obstructive pulmonary disease (emphysema)

- Coronary artery disease (angina pectoris and ischaemic heart disease)

- Crohn’s disease

- Diabetes insipidus

- Diabetes mellitus type 1 & 2

- Dysrythmias

- Epilepsy

- Glaucoma

- Haemophilia

- HIV/AIDS*

- Hyperlipidaemia (high cholesterol)

- Hypertension (high blood pressure)

- Hypothyroidism

- Multiple sclerosis

- Parkinson’s disease

- Rheumatoid arthritis

- Schizophrenia

- Systemic lupus erythromatosis

- Ulcerative colitis

Health Status

You should consider full cover when you or one of your family members suffer from chronic medical condition(s). It’s important to note that should you choose hospital cover, any other medical problems are provisioned for by your medical aid.

Financial Status

There are many options to choose from depending on your financial status. Full medical cover can be expensive. When joining a scheme, see who gives you and your family the best deal. Know exactly what your monthly contributions would be and the benefits provided by the scheme.

Scheme Track Record

Speak to your broker regarding the schemes latest solvency ratio information. The law stipulates that a scheme should have at least 25% of its member’s annual contributions in reserve. Contact your doctor and find out if they experience any problems regarding any claim payout submission for the scheme.

Scheme Benefits

It’s with great importance that you should review your scheme’s benefits. Be sure you know exactly what your Medical Savings Account is per annum. Should your (MSA) benefit be depleted yearly in the year, you should consider changing your medical plan. Xperthealth provides a comprehensive tool to compare medical aid benefits.

Independent Broker Consultation

Our consultants are experts in their field, are highly experienced and professional and live up to our promise of delivering the best advice on different medical aid options, benefits and cover.

Hospital Limits

There are three types of medical aid benefits:

- Day to Day Cover

- Chronic Cover

- Hospital Cover

Hospital cover pays for the medical expenses when you or your one of you family members is hospitalized. The cost includes medication, doctor’s fees, surgical procedures, test and X-ray scans.

Some plans have an annual limit set for its member for hospital cover, while other plans provide an unlimited hospital benefit.

Electronic Scheme Forms

Broker Appointment Forms

Recent Posts